We made it guys! The weather is warm, school is out, and it’s time to enjoy the sunshine! But if you are like us, you might have noticed that money tends to get a little tighter this time of year. So over the years, my husband and I have started doing a few things to help us keep up on our budget.

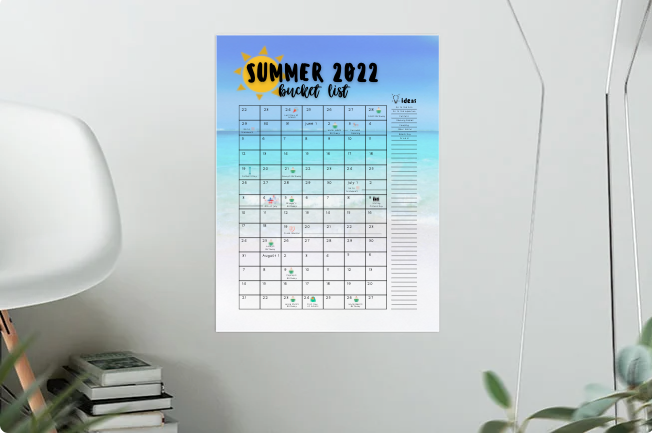

Plan Out the Summer Activities

One thing we have started doing to prepare for our summer is to make a big list with alllll the activities we have planned, and our wishlist of things we would like to do. This year, since we have a toddler, I made a poster on Canva that goes from the last week of school to when Mommy starts school again. We marked our family reunions, holidays, weekends at Grandma’s, and put pictures with it to help the kids know what is coming up. After that, we start filling in when we want to do those extra things so we make sure we get everything that we want to squeezed into those couple of months.

Pre-Budget Bigger Activities

The next thing we’ve started doing is we look at that list, and we make a list of all the admission fees for where we’ve wanted to go. Then we will save that amount in the savings account, so we know we have the money when it’s time to go. That way we can fit things like snacks or souvenirs into the regular budget.

Look for Regular Sale Patterns

Some of the places on our wishlist are a little pricey. But, we know that on holiday weekends, or towards the end of the summer, they have big sales where the admission prices are up to 50% off! So when we look at planning those particular trips, we want to aim them to the weekends when we will get a better deal.

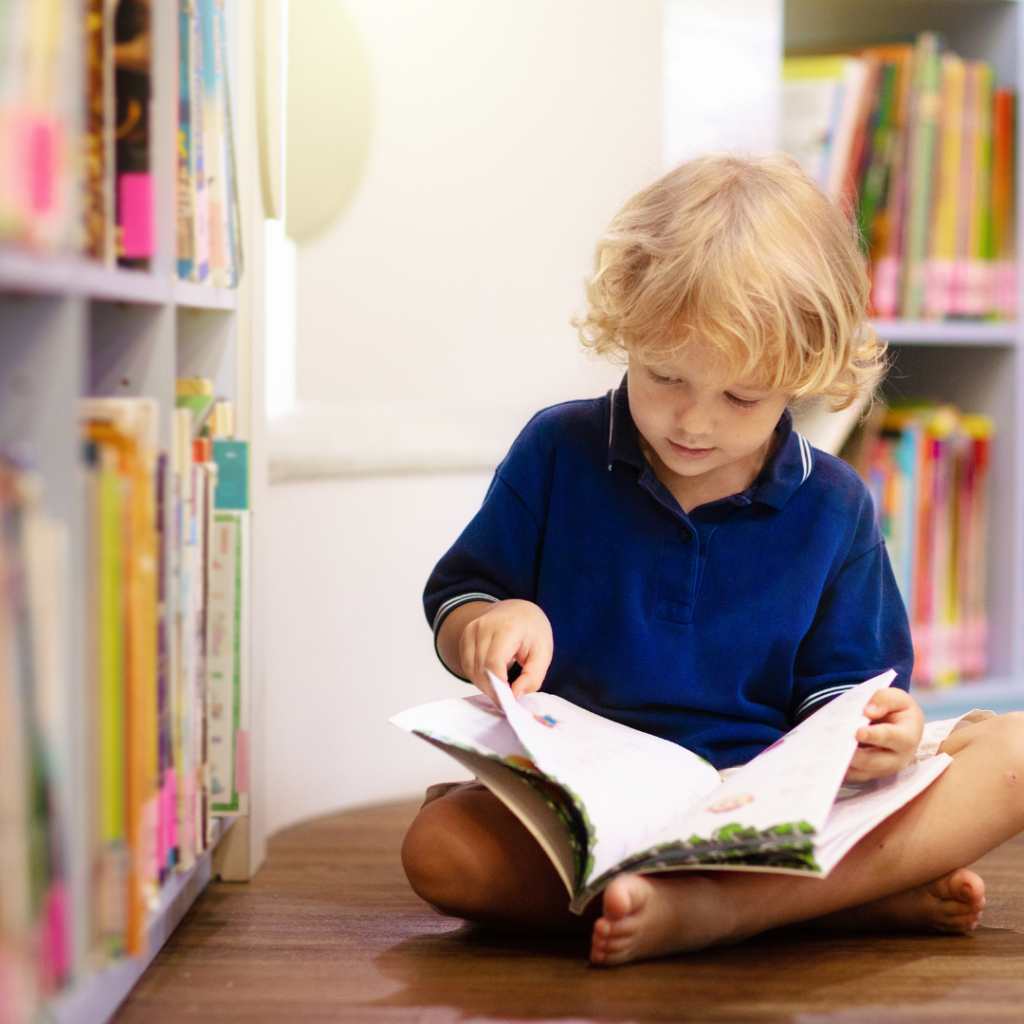

Set Routines with Free Activities

With littles staying at home, it can get expensive to keep them entertained. Visits to the swimming pool, getting treats, all those things add up! So this summer I am planning an outing routine with things we can do for free. I’m including: playing at the park, splash pad days, library trips, nature walks, and movie day on our schedule so that we have something to look forward to each day, but it’s not going to be overwhelming on the budget.

Plan a Staycation

Another great way to save money this year is to plan a staycation. This can save you on money on hotels, travel, and car snacks. You can pick a weekend to stay home, go on outings and adventures together, but save so much, especially with gas prices these days.

Passes or Punch Cards

In previous years, we have also purchased passes that gave us free admission to various passes. (Last year we tried Get Out Pass and loved it!) This year however, there weren’t as many things we wanted to do on it, so it ended up being the same amount to just put it in the savings account, but because we had pre-budgeted, we knew that!

Check Out Community Activities

Another one of my favorite things to do to have fun and spend less in the summer is to take advantage of our community events. Rexburg, where we live, is so good at having big events in the parks with activities, food, and music, and it’s so fun. We try to go to the farmer’s market each week, and participate in community parties for things like the Fourth of July and Pioneer Day. Most communities have Facebook pages, local radio station calendars, or community event calendars online to let you know what is coming up!

Spend Time Outside

Spending time outside in the summer can help save money. Think of all the things you can do outside of $0! You could: play pickle ball/tennis/basketball/soccer/volleyball at local courts. You can play at the park or local splash pads. You can go on a nature walk or hike. You could swim in a river or lake. Spending time outside can add to your fun bucket list, without taking away from your finances.

Cook on the Grill

An unexpected benefit to a favorite summer tradition of cooking on the barbecue or in the dutch oven is it can help save money! Cooking outside helps to not heat the house, which can help keep your gas and electric bills down.

Have Snacks Passed for On-the-Go

A sneaky money-sucker during the summer is snacks. You’re out running errands and having fun, and someone gets hungry. Why not stop at the local soda-shoppe, or at the gas station, or at a little vendor close by and get some food. Now, I’m not saying avoid that entirely, that’s part of the fun of summer, but having snacks in the diaper bag, or in the car ready to go can help curb some impromptu spending that could derail your financial goals.

Summer is a great time to spend time with family, have some fun, and enjoy the nicer weather! Having some plans set ahead can help you stay on budget!

XO, Cheri